What do Singaporean home buyers need to know in 2016?.

Last year may have been the year of but this year is definitely starting to be the year of.

In Malay, “rugi” means to lose out. Why is it the year of losing out? Because if you just bought a car before the COE dropped by $9,000 last week, you definitely "rugi" We’ll be talking more about the COE drop soon. Today, though, we’re going to talk about housing prices in Singapore, and how now is almost definitely the right time to buy a new home.

Unlike the sudden drop in COE, housing prices in Singapore have been dropping steadily

The price index for private residential properties in Singapore dropped 3.7 per cent in 2015, compared to a 4.0 per cent drop in 2014. While it’s hard to really say if this suggests that the price drop is slowing down, it’s definitely clear that prices can be expected to keep dropping for the next year, at least.

What’s going to make this worse, is the fact that supply of properties is on the rise. A staggering 27,149 private residential units are expected to be completed by this year. This number is including Executive Condominiums. In comparison, only 23,298 units (including ECs) were completed in 2014.

The private resale market in 2015 has been doing a little better compared to 2014, though that’s not really saying much, since 2014 saw the lowest number of resale transactions in the past 5 years. As a result, the vacancy rate almost nearing 8 per cent in 2015, the highest it’s been in the past 5 years.

The HDB resale market is doing only slightly better, with resale prices rising by an estimate of 0.2 per cent last quarter, after steadily falling since the 2013 high.

On the other hand, as with previous years, HDB BTO applications in 2015 have always exceeded supply, and even launching the bumper crop of 12,411 flats in the last exercise saw an oversubscription by more than 3 times the available units. This despite flats in non-mature estates like Sengkang and Punggol still going from $143,000 to $353,000 and above.

But 2016 promises to bring as many as 28,000 new HDB flats, or about 2,000 more than last year.

What does this all mean for you if you’re buying a house in 2016?

Simply put, it would suggest that there’s no better time to buy property in Singapore. With prices falling andf supply rising, it’s really a buyer’s market out there. However, because buying a property in Singapore can be a complicated process, you should be aware of what you’re getting yourself into. It is, quite possibly, going to be the biggest financial decision of your life.

4 tips on paying for your first home

Financial advisers say you should plan your housing budget carefully before choosing your home and not the other way around.

There are many tools available out there which first-time home buyers can use to plan their purchases.For example, Mrs Nyang-Ngiam said, "they can make use of Our First Home Calculator available on the CPF website to assess the type of housing they can afford based on their income and ability to service the loan".The experts also urge would-be buyers to consider the full range of costs and monthly bills prior to purchase.

"Once you own the property, you will also incur other regular costs like utility bills, conservancy fees and management fees if your property is a condominium with facilities like a swimming pool, gym and tennis court," said Mr Vasu Menon, vice-president of wealth management in Singapore at OCBC Bank.Saving for the down payment could take several years for most people, given the steep rises in property prices in recent years.

Property down payments for first-timers could range between 10 per cent and 20 per cent of the purchase price, depending on whether you buy an HDB flat or a private property and whether you finance this using an HDB loan or a bank loan. "Save at least 10 per cent of your income each month and do this before you even start spending," said OCBC's Mr Menon.

He added that home buyers will need to build up a pool of funds through savings and investments.One common question is whether to get an HDB loan or to borrow from the bank. They have their pros and cons.

For instance, a bank loan requires a cash down payment of at least 5 per cent while an HDB loan allows full financing of the down payment using just CPF funds.HDB loans tend to offer better interest rate stability, as the rate is pegged at 0.1 percentage point above the prevailing CPF interest rate. Thus, they provide relatively more stability than even a fixed-rate mortgage whose rate is fixed for only a certain number of years.

But HDB loans also come with certain eligibility conditions.Home buyers should also evaluate the impact of regulations on their financing options and costs, say the bankers.

Some may still be unaware of - or do not understand - the total debt servicing ratio (TDSR) framework for property loans that was introduced last year, noted UOB's Ms Chia.

The TDSR caps a borrower's monthly total debt repayments at 60 per cent of his gross monthly income.A key financial consideration at this juncture is the outlook for interest rates, say the experts.

"While rates are low for now, remember that they may rise in the coming years," said OCBC's Mr Menon. "When rates do increase, your monthly instalments will rise, and you should assess if this will pose a burden before deciding on the amount of loan you plan to take and the package you wish to sign up for."Home buyers should also set aside sufficient funds to meet rising interest rates and any unforeseen circumstances.

UOB's Ms Chia pointed out that for every one percentage point rise in the interest rate, the monthly instalment will rise by about $250 for a $500,000 loan stretched over 30 years.

To ensure financial liquidity, it is also prudent for home buyers to maintain 18 to 24 months of monthly instalments in their bank accounts, she added.

What do new HDB buyers need to know in 2016?

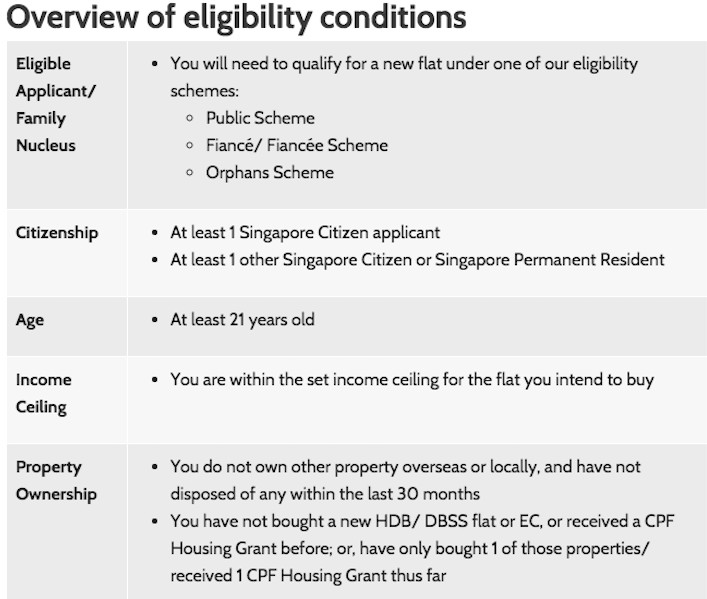

First, make sure you’re eligible to buy a flat from HDB. And just because you’re eligible now doesn’t necessarily mean you’re ready – we know that in 2013, 1 in 5 couples under the Fiance/Fiancee Schemes eventually cancelled their BTO application. So be sure you’re ready to take the plunge.

Second, you should make sure all your finances are in order. Even if you’re a Facebook co-founder, you’ll probably want to take out a HDB loan or a bank loan in order to finance your purchase. Make sure you meet all the eligibility requirements, especially the income ceiling. It’s important to also find out just how much you can loan – there’s no point looking at residential units that cost more than the amount you’re able to borrow.

The other thing you definitely need to consider is what the downpayment is. If you’re taking a HDB loan, your downpayment is 10 per cent of the purchase price. This can be paid using cash or CPF. If your flat costs $400,000, for example, then you can pay $40,000 from your CPF to cover the downpayment. Assuming you have that much in your Ordinary Account, of course.

If you are taking a bank loan, then your downpayment will be whatever your loan doesn’t cover. If you get the maximum loan of 80 per cent of the purchase price, then your downpayment is 20 per cent of the purchase price. That means if your flat costs $400,000, your downpayment is $80,000. Unlike HDB loans, a part of the downpayment has to be in cash. When the downpayment is 20 per cent of the purchase price, 5 per cent will need to be in cash. That’s $20,000 in cold, hard cash you need to have on hand. If you don’t have that much cash on hand, the last thing you should do is take out a personal loan. Instead, you should probably consider looking for a cheaper unit.

Of course, there’s more costs involved than just the downpayment. Option fees, stamp duty, legal costs and housing agent fees are just some other miscellaneous costs that you will incur. But the downpayment is still the biggest upfront cost. So you should definitely never underestimate it.

There’s no one answer to say which is better: taking a HDB loan or a bank loan. It all depends on your current situation.

One more thing, if you’re a first-timer, you should definitely take advantage of the priority given to you and only apply for the location you want. First-time HDB applicants in the latest exercise were allotted between 70 per cent to 85 per cent of the flat supply in a non-mature estate, and 95 per cent of the flat supply in the Bidadari estate. Even then, there was generally more first-time applications than units available.

5 money traps couples fall into when buying their first property

Click on thumbnail to view. Story continues after photos. The Straits Times

Thanks to the government's slew of cooling measures, among which are capping MSR at 30 per cent for HDB flats and TDSR at 60 per cent for all properties, you should find yourself unable to seriously overextend yourself even if you are tempted to.- Staying home to look after children may potentially half your income.

- Interest rates are at rock bottom currently but they will most definitely go up.

- Property prices are not at fire sale prices.The ABSD will not last forever, but your property may (especially if it is freehold). One must remember they are one of a set of cooling measures to rein in property prices and keep them affordable for first-time property buyers.However, if property prices were to start tanking significantly, it is likely that the current measures, including ABSD, will be relaxed layer by layer, like peeling an onion. After all, it is to no one's benefit for the single largest asset owned by most of us to depreciate.Refinancing later on comes with many risks, including the interest rate environment then, your employment situation then, the state of the economy and property market then (affecting the valuation of your homes) and government/banking policies then (which affect whether legal subsidies can be given by banks).Even if the initial rates are 0.1 per cent higher than the other bank's, what you'd want to ensure is that the rates after the initial years are competitive, in case you are unable to refinance to your advantage when the lock-in period is over.It may be tempting to buy a 500 or 600+ sq ft condominium unit at less than S$1million, especially for professionals or HDB dwellers looking to buy an investment unit.Do keep in mind the thousands of units coming into the market over the next few years, which means that it may not be easy to rent out or sell your unit at a profitable price. This while it locks up your 'quota' for property ownership with ABSD and punitive financing quantums for subsequent property purchases.An old property on a 99-year lease is simply what it is, an old property with a shorter life span. One should always assume that the value of the property will be zero at the end of the lease and ask ourselves if we are comfortable paying the amount for the remaining lease.If you are contemplating marriage and buying your first property in the foreseeable future, it is good to use the above as a checklist to have the necessary discussions with your significant other before making the largest purchase of your life.

What do private home buyers need to know in 2016?

When it comes to buying private property in Singapore, obviously there’s no option for a HDB loan. Which means, unless you’re a regular on Forbes’ list of billionaires, you probably need to get a home loan with a bank.

As mentioned above, for a bank home loan, you will need to come up with at least 20 per cent of the purchase price as a downpayment. Of the 20 per cent, 5 per cent needs to be strictly in cash, while the remaining 15 per cent can come from cash or CPF. Note that I said: at least. Because of the loan requirements, your downpayment could be as high as 80 per cent of the purchase price if you already have an existing home loan on one or more properties, and your loan tenure is more than 30 years, up to a maximum of 35 years.

How much you can loan from a bank depends on a number of factors too. Limitations like the Total Debt Servicing Ratio means you can only borrow up to 60 per cent of your monthly income. And this includes other debt obligations too, like your credit cards, car loans and education loans.

Ultimately, you should get an in-principle approval, or IPA, from the bank you’re planning to borrow from. This is an indicator of how much you are able to borrow.

Which bank’s home loan should I choose? There are so many.

Great question. Currently there are three main types of home loans available: fixed rates, SIBOR-linked floating rates and fixed deposit-linked floating rates with DBS or OCBC.

Currently, the 3-month SIBOR is at 1.19 per cent and expected to increase significantly, which means you’re probably better off with the DBS FHR18 at 0.6 per cent or the OCBC 36FDMR at 0.65 per cent.

Of course, you can’t just look at the rates, you should also take note of the spread, or the additional interest rate charges imposed by the bank.

But don’t wait too long to decide – the last thing you want is for 2016 to truly be for you.